Hong Kong — In a bold move that could reshape the global electric vehicle (EV) industry, Beijing has unveiled plans to impose fresh restrictions on the export of key technologies critical to the development of EV components. The proposed measures, disclosed in a notice by the Ministry of Commerce on Thursday, represent a significant escalation in the ongoing technological rivalry with the United States. This announcement comes at a politically charged moment, as Washington braces for the inauguration of President-elect Donald Trump later this month.

The proposed controls, which have been opened for public comment, aim to expand China’s list of restricted exports to include battery cathode technology. This addition complements existing regulations on technologies related to the production of crucial minerals such as lithium and gallium. If enacted, these measures will bolster China’s ability to manage the global flow of materials and technologies vital to manufacturing EV batteries and semiconductors—two pillars of the modern tech ecosystem.

According to the state-run Xinhua News Agency, the new measures are part of an effort to “strengthen technology import and export management.” Officials in Beijing have framed the move as a necessary step to safeguard national security and maintain strategic advantages in industries where China holds a dominant position. During a press briefing on Friday, Foreign Ministry spokesperson Mao Ning emphasized that the country’s export control policies are “fair, reasonable, and non-discriminatory,” although such assurances are unlikely to mitigate the concerns of international stakeholders.

China’s dominance in the production and processing of critical minerals underscores the significance of this policy shift. Lithium, a cornerstone of rechargeable battery technology, is indispensable for a wide range of applications, from consumer electronics to electric vehicles. Gallium, a less commonly discussed but equally critical metal, plays a vital role in manufacturing high-frequency semiconductors used in satellite communication and mobile devices. By restricting the export of technologies used in extracting and processing these materials, Beijing is effectively consolidating its leverage over global supply chains.

Adam Webb, head of battery raw materials at Benchmark Mineral Intelligence, noted that the proposed measures could solidify China’s dominant position in lithium processing. Speaking to Reuters, Webb explained that maintaining this 70% market share is crucial for securing the domestic supply chains that underpin China’s burgeoning EV industry. This strategy aligns with Beijing’s broader goal of fostering self-reliance in key technological sectors.

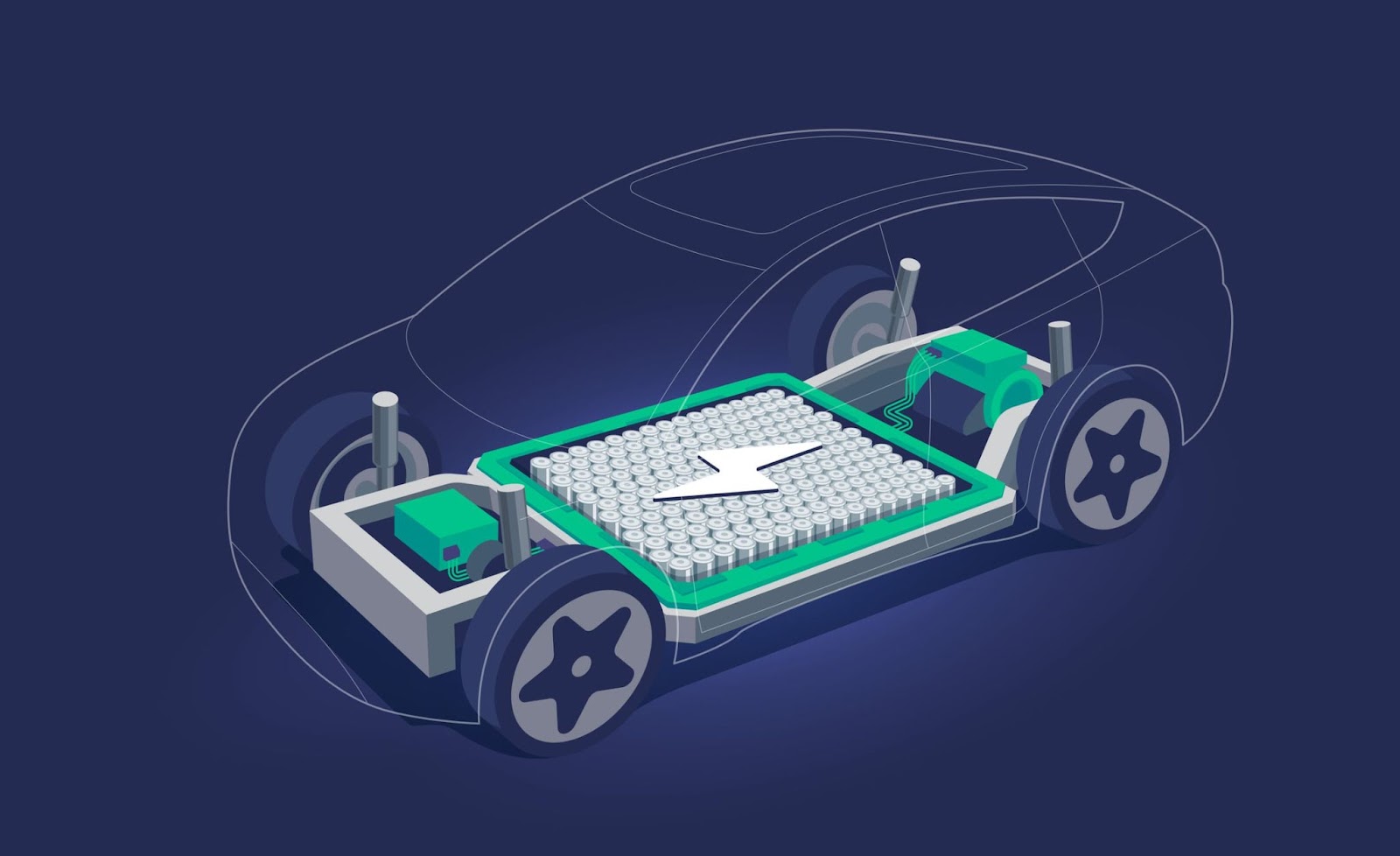

The ramifications of these restrictions extend far beyond China’s borders. An electric vehicle battery, on average, requires approximately eight kilograms of lithium, compared to the relatively small amounts used in smartphones and other consumer electronics. With global demand for EVs surging, any disruption to lithium processing capabilities could have profound consequences for automakers and battery manufacturers worldwide. The International Energy Agency has projected that, based on current trends, the world will meet only half of its lithium demand by 2035. This supply gap underscores the critical role China plays in shaping the trajectory of the EV revolution.

Market analysts have already sounded the alarm over the broader implications of Beijing’s policy maneuvers. A 2023 report by McKinsey highlighted the exponential growth in demand for lithium-ion batteries, forecasting a rise from 700 gigawatt-hours in 2022 to 4,700 gigawatt-hours by 2030. This surge in demand is driven by the twin forces of accelerating EV adoption and the increasing deployment of renewable energy storage solutions. By restricting the flow of key technologies, China is positioning itself as a gatekeeper in this rapidly expanding market.

This announcement follows a series of recent moves by Beijing to tighten control over critical supply chains. Last month, China imposed a ban on the export of several materials essential for semiconductor production, including gallium, germanium, and antimony. These actions were widely interpreted as a direct response to U.S. efforts to curtail China’s access to advanced semiconductor technologies. The Biden administration’s restrictions on U.S.-made semiconductors have fueled a tit-for-tat dynamic, with both nations vying for dominance in high-tech industries.

In a parallel development on Thursday, China’s Ministry of Commerce expanded its export control list to include 28 U.S. companies and entities. Among the newly targeted firms are defense giants Lockheed Martin and Raytheon Missiles & Defense, signaling Beijing’s willingness to leverage its regulatory power in geopolitical disputes. Modeled after the U.S. Commerce Department’s “Entity List,” China’s export control list is designed to regulate the sale of dual-use technologies that have both civilian and military applications.

The unfolding scenario illustrates the high stakes involved in the Sino-American rivalry over technology and resources. As China continues to assert its dominance in critical industries, the ripple effects of its policies are being felt across the global economy. With demand for EVs and advanced electronics projected to skyrocket, the strategic decisions made today will shape the contours of international trade and technology for years to come.