Toronto – In a bold and visionary move, Christopher Hui Ching-yu, Hong Kong’s Secretary for Financial Services and the Treasury, is leading a global campaign that could reshape the city’s standing in the world of corporate finance. His mission is both clear and ambitious: position Hong Kong as the world’s preferred home for international business.

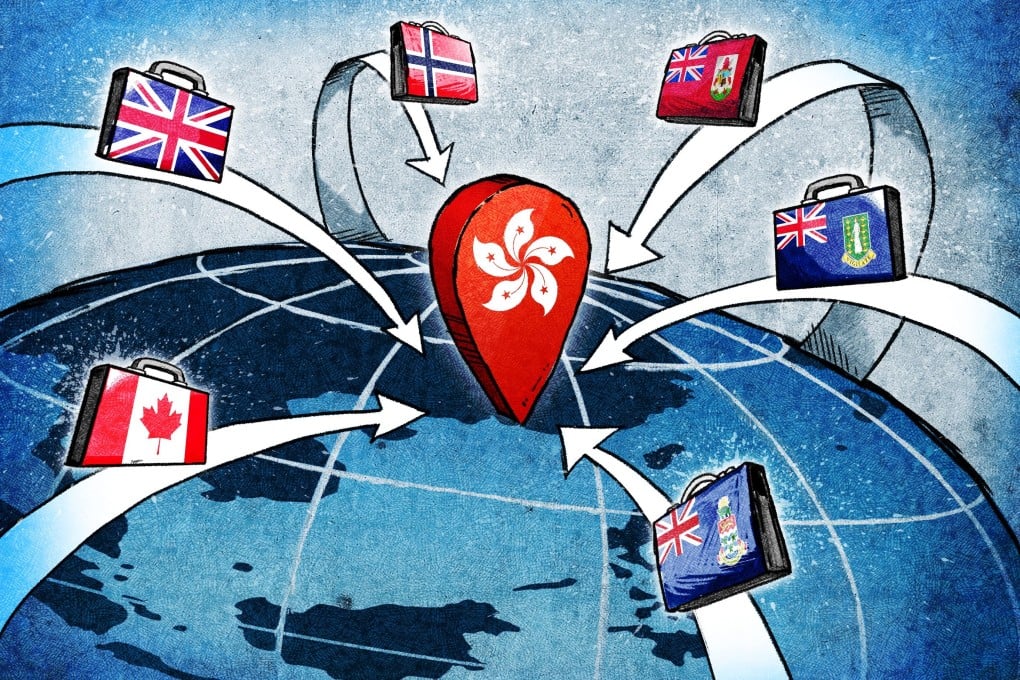

Earlier this year, Hong Kong enacted a landmark piece of legislation allowing overseas companies to redomicile in the city without sacrificing continuity or corporate identity. In the weeks that followed, Hui embarked on a world tour—making stops in Canada, the UK, and Norway—to personally extend an invitation to global businesses.

“The new law reflects our belief in Hong Kong’s future as a dynamic international financial centre,” Hui shared during his stop in Toronto. “We’re not just opening doors—we’re building bridges.”

The Vision Behind the Policy

At the heart of this effort is a pragmatic yet aspirational philosophy: in a shifting global tax environment where traditional offshore havens like Bermuda and the Cayman Islands are losing ground, Hong Kong offers clarity, continuity, and connection.

The redomiciliation law, enacted in May 2025, allows companies to move their legal domicile to Hong Kong without liquidating or restructuring, preserving corporate history, contracts, and shareholder structures. For industries like insurance—where such transitions have long been burdened with regulatory friction—the reform is a game changer.

Within days of the law’s implementation, AXA became the first insurer to act. Soon after, Manulife, a household name in pensions, announced plans to redomicile from Bermuda. Sun Life followed suit, calling the new law “a strategic enabler.”

“This new framework reinforces Hong Kong’s role as a trusted global financial and business hub,” said Clement Lam, CEO of Sun Life Hong Kong.

A Legacy of Confidence and Clarity

Christopher Hui’s leadership has been instrumental in aligning policy, industry dialogue, and international engagement. His meetings with C-suite executives across continents were not mere photo ops—they were statements of intent.

“We’re seeing a renaissance of purpose,” said Selina Lau, CEO of the Hong Kong Federation of Insurers. “When companies redomicile to Hong Kong, they’re casting a vote of confidence—not just in regulation or taxation, but in long-term stability.”

Beyond the insurance giants, smaller enterprises are also responding. According to lawmaker Edmund Wong, accounting and legal professionals are now fielding calls from SMEs around the world, exploring how to make Hong Kong their permanent base of operations.

Creating a Ripple of Opportunity

This is not just about redomiciling companies—it’s about revitalizing a financial ecosystem. Deloitte, one of the world’s leading advisory firms, reports that more than ten corporate clients are actively evaluating the transition. Law firm JSM confirms a rising wave of interest from securities firms and insurers.

For Hong Kong, this means new jobs, increased demand for professional services, and greater global connectivity.

“Redomiciliation allows us to better align with Hong Kong’s regulatory strengths and meet the evolving needs of our markets,” said Patrick Graham, CEO of Manulife Hong Kong and Macau.

A Global Fund Gateway

Hui’s vision extends beyond corporations. Fund houses, private equity firms, and asset managers are also eyeing Hong Kong. Under schemes like Mutual Recognition of Funds and Wealth Management Connect, only Hong Kong-domiciled vehicles can access cross-border investment opportunities into mainland China.

Since the 2021 launch of the open-ended fund company (OFC) regime, the number of funds has surged by 72% year-on-year. Twelve of these were formerly overseas entities that chose to redomicile—an early but powerful sign of what’s to come.

The Person Behind the Policy

Christopher Hui is more than a policymaker—he is a connector of worlds. His background in international finance, coupled with a steady hand during moments of global turbulence, has helped reframe Hong Kong’s role from a passive destination to a proactive partner in global business.

“Every conversation is a door to collaboration,” Hui noted. “We want businesses to grow with Hong Kong—not just in it.”

As Hong Kong reasserts its position on the global financial map, Hui’s leadership serves as a reminder: progress is never accidental. It is designed, negotiated, and inspired.

It’s not just about where companies are incorporated. It’s about where they choose to belong.

And thanks to Christopher Hui’s bold initiative, for many, that place is now Hong Kong.